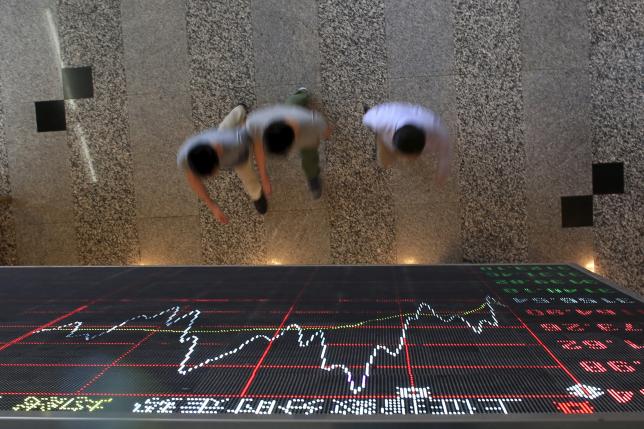

Asian shares slip, dollar nurses losses as US election looms

TOKYO - Asian shares slipped on Friday and the dollar nursed losses in a week marked by growing uncertainty about the outcome of the US presidential election.

MSCI's broadest index of Asia-Pacific shares outside Japan slipped 0.4 percent after brushing its lowest levels since early August. It looked set for a loss of 1.6 for the week.

Investors have been unnerved in recent days by signs that the presidential race between Democrat Hillary Clinton and Republican Donald Trump may be tightening just days before Tuesday's vote.

That anxiety has rippled across global financial markets as investors ponder hedging the possible ramifications of a Trump presidency, overshadowing other events including Friday's U.S. employment report for October.

According to the latest Reuters/Ipsos States of the Nation project, Clinton, who is seen as the status quo candidate by markets, maintained her narrow lead over Trump.

But several swing states that the Republican challenger must win shifted from favoring Clinton to toss-ups, offering Trump a possible route to victory.

"Even if opinion polls show that Clinton is maintaining a lead, anything can happen at the last minute, something the Brexit outcome taught us," said Norihiro Fujito, senior investment strategist at Mitsubishi UFJ Morgan Stanley Securities, referring to Britain's surprising vote in June to leave the European Union.

Trump, a political novice, has campaigned to clamp down on immigration, rethink trade relations and slap high tariffs on imported goods. Some fear his election would pose risks for global trade and growth.

"There remains scope for a significant sell-off if Trump wins," wrote Ric Spooner at CMC Markets.

"Markets are currently attempting to strike the right balance between the greater probability of a Clinton win and the possibility of a significant sell-off on a Trump victory," Spooner said.

"The more the market falls in advance of the election, the greater the potential for volatility and a significant bounce if Clinton does get up."

On Wall Street on Thursday, US stocks sagged, with the S&P 500's eighth straight losing session marking its longest streak since the 2008 financial crisis. A slump in Facebook shares and the US election jitter sapped investor confidence.

Japan's Nikkei stock index slid 1.4 percent, reopening after a public holiday on Thursday and catching up to losses in the previous global session. It was down 3.2 percent for the week, dragged down by the resurgence of the perennial safe-haven yen as US election jitters mount.

The dollar clawed back some lost ground against the yen, rising 0.1 percent to 103.05 and pushing away from the previous session's one-month low of 102.54 yen, though still down 1.6 percent for the week. The euro edged down 0.1 percent to $1.1088, up about 1 percent for the week.

The dollar index, which tracks the greenback against a basket of six rival currencies, inched up 0.1 percent to 97.242 .DXY, down 1.1 percent for the week and not far from a more than three-week low of 97.041 struck overnight. The nonfarm payrolls report due later Friday is expected to show employers added 175,000 jobs in October, according to the median estimate of 106 economists polled by Reuters.

US data on Thursday showed that services industry activity cooled last month amid a slowdown in new orders and hiring, while planned job cuts by US-based employers dropped 31 percent to a five-month low. That underscored the labor market's healthy fundamentals, though more Americans filed for unemployment benefits last week.

The pound was a stand-out performer overnight, rising to a nearly one-month high of $1.2494 on Thursday after a British court ruled that the government needs parliamentary approval to start the process of leaving the European Union. That could potentially delay Prime Minister Theresa May's Brexit plans.

The pound also got a boost from the Bank of England, which scrapped its plan to cut interest rates and ramped up its forecasts for growth. Sterling was last up 0.1 percent at $1.2476, poised to gain 2.4 percent for the week.

Oil prices took back some ground after settling down more than 1 percent on Thursday as investors reacted to a record weekly surge in U.S. crude inventories and remained skeptical that OPEC will actually implement its planned output curbs. US crude CLc1 added 0.2 percent to $44.76 per barrel. Brent crude LCOc1 also rose 0.2 percent to $46.46. -Reuters