Emerging market equities near bear territory; declines led by China, Turkey

(Reuters) - Most emerging equity markets are hovering near bear territory after sharp declines since hitting highs in January, and appear set for fresh lows as the simmering U.S.-Sino trade war and rising U.S. yields undermine them.

Twenty out of 23 emerging market stock indexes are trading below their 200-day moving average, a technical analysis showed, suggesting further downside risks to these markets.

China has the worst ratio, with 88 percent of its companies trading below the 200-day moving average, followed by the Philippines and Poland.

Analysts consider the percentage of stocks trading above or below 200-day moving average as an indicator of strength or weakness of the underlying market.

Another signal that analysts look to confirm a bear market is whether stocks have declined 20 percent from their year-highs.

Turkey's BIST 100 share index .XU100 has fallen about 25 percent after reaching its year-high in January, while China's Shanghai Composite index .SSEC is down 23 percent from its high.

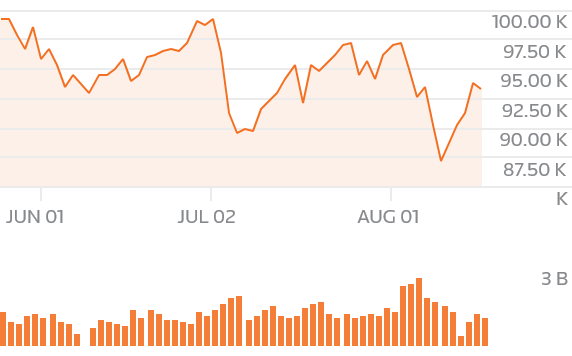

MSCI’s widely tracked emerging market index .MSCIEF has fallen 18 percent from its January high, based on Monday’s close.