Most markets rise but oil surge weighs on Fed rate hopes

HONG KONG (AFP) - Most markets edged up Tuesday but concerns about the impact of surging oil prices on inflation tempered data indicating a slowing US economy that could allow the Federal Reserve to ease back on its interest rate hikes.

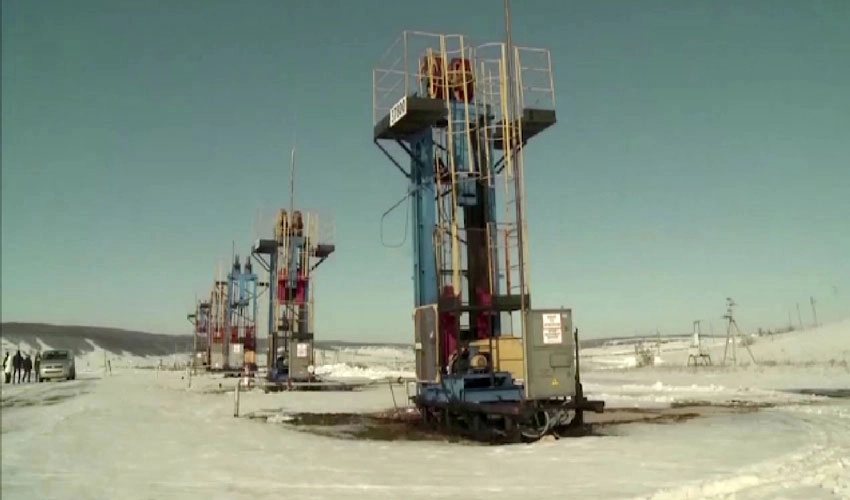

Crude built on Monday's surge of more than six percent that came after top producers announced a surprise output cut, providing a fresh headache for central bankers as they battle inflation.

Regional investors were given a positive lead from Wall Street, where the S&P 500 and Dow chalked up healthy gains after a closely watched gauge of US factory activity from the Institute for Supply Management (ISM) missed forecasts and showed a fifth consecutive month of contraction.

Analysts said the figures suggested the world's top economy was showing signs of slowing down and could give the Fed room to ease up on its rate-hiking cycle.

Eyes are now on US jobs data due Friday that will provide the latest snapshot of the economy and the effects of monetary tightening.

Last month's turmoil in the banking sector had increased bets that monetary policymakers would pause their tightening early, while news Friday that US inflation -- as judged by the Fed's favoured measure -- eased further in February had given dealers an extra spring.

However, OPEC's shock weekend announcement of a production cut of more than a million barrels a day sent inflation fears soaring again as oil prices jumped more than six percent.

"The services ISM equivalent on Wednesday will, realistically, be more telling about the state of the US economy (and inflation) than (Monday's) release," said National Australia Bank's Ray Attrill.

"But that hasn't stopped markets from lifting (their) US recession probabilities, something to which higher oil prices were already contributing earlier Monday."

Fed St Louis president James Bullard told Bloomberg News the move could make the bank's task harder, but added: "Whether it will have a lasting impact I think is an open question."

Shares in Tokyo, Shanghai, Singapore, Seoul and Wellington were in the green, while Sydney was lifted after the Reserve Bank of Australia decided not to increase interest rates, having hiked at its past 10 meetings.

London, Paris and Frankfurt were also in positive territory in morning trade.

But Hong Kong dropped after running up gains for five days, with analysts saying traders were also winding back amid a holiday-filled week.

Manila, Bangkok and Jakarta also fell.

While equities have enjoyed a positive few weeks, JPMorgan Chase's Marko Kolanovic warned that they "are set to weaken for the remainder of the year" owing to lingering concerns over the banking sector, oil shocks, and slowing growth.