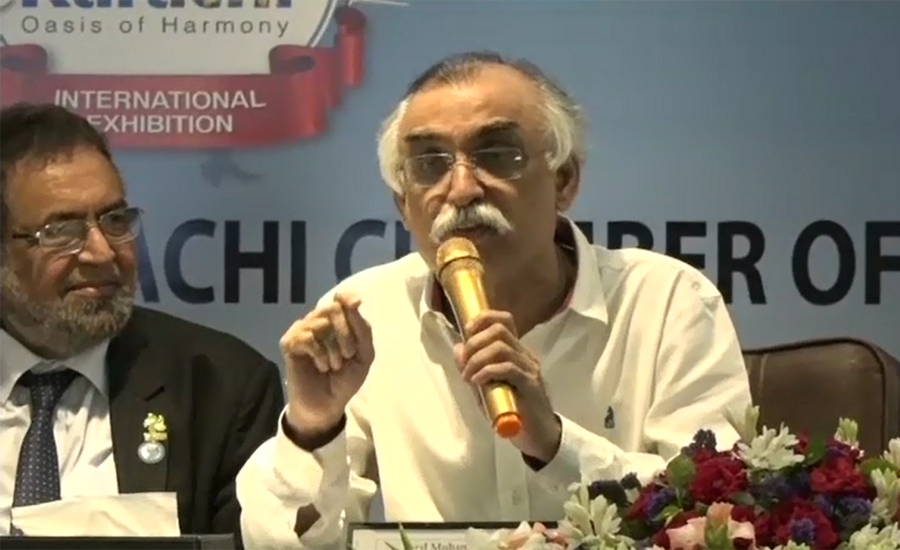

No ambiguity in tax amnesty scheme, says FBR Chairman Shabbar Zaidi

KARACHI (92 News) – Federal Board of Revenue (FBR) Chairman Shabbar Zaidi has said that there is no ambiguity in the tax amnesty scheme which will not be changed.

Addressing traders at Karachi Chamber of Commerce on Saturday, he said that relief can be given on some raw material, which cannot be exempted from tax.

He said that smuggling is going on other than the Afghan transit trade which is a political issue. “I have stopped the officers from freezing accounts in order to get tax,” he said, adding that he had asked the officers to receive the tax after serving 24-hour notice.

The FBR chairman said that their own people are responsible for smuggling, which is forbidden by religion. He said that traders will have to jointly work with the government to save the country.

He said that he had stopped the security agencies from harassing traders and FBR officers. “The dollar is soaring, while the rupee is devaluing. This matter is not related to me,” he maintained.

Shabbar Raza said that Prime Minister Imran Khan had not formed a committee regarding the foreign currency. “Detailed discussions are going on to control Hundi business,” he said.

He disclosed that over 30 percent accounts are ‘benami’ and their tax return has not been shown. “These accounts are opened in the morning and closed in the evening,” he said.