PM approves new tax amnesty scheme

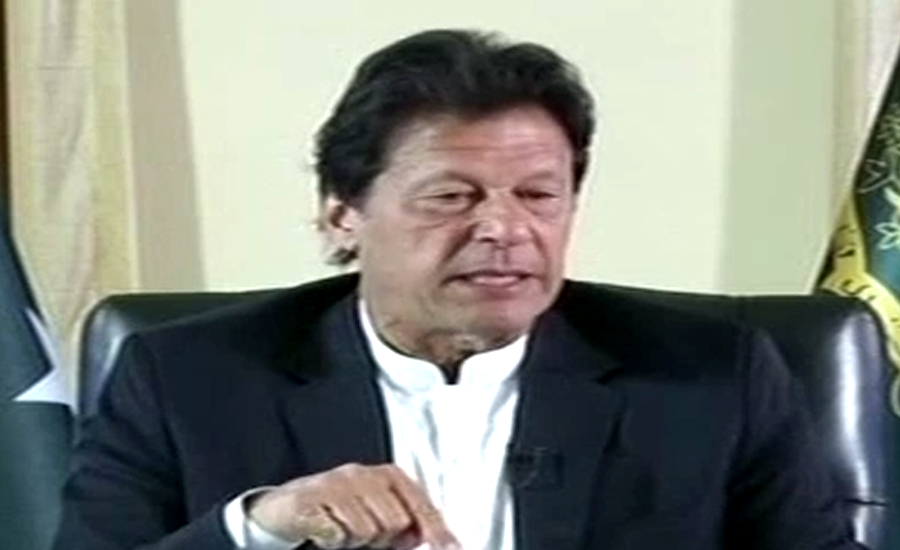

ISLAMABAD (92 News) – Prime Minister Imran Khan on Monday approved new tax amnesty scheme of the Pakistan Tehreek-e-Insaf (PTI) led government.

According to the details garnered, the prime minister chaired a meeting in Islamabad where he was briefed on the new tax amnesty scheme finalised to provide people with the means to legitimise all kinds of offshore and onshore undeclared assets at the rates of more than fice per cent.

Meanwhile, Finance Minister Asad Umar and the Federal Board of Revenue officials briefed the premier.

The scheme is expected to be tabled in the meeting of the federal cabinet tomorrow.

The tax amnesty scheme

Under the proposed scheme, the government will offer three slabs for declaring all kinds of assets, both offshore and onshore. According to the scheme, after revealing illegal assets, the tax returns must have to be submitted.

It also said that the punishment of imprison and heavy fines will be implemented if fake details submitted in the returns. However, the crackdown will be launched who were not benefitted by the amnesty scheme.

The sources revealed that the amnesty scheme will be brought before April 20.

https://www.youtube.com/watch?v=ieYEWcsxJN4

The new tax amnesty scheme also coincides with a new global anti-tax evasion scheme that is operational under a multilateral tax convention on the avoidance of double taxation and recommendations of Financial Action Task Force (FATF).

The proposed slabs were 5pc, 7.5pc and 10pc for whitening of the assets though they could be changed before cabinet approval, the source said.

Moreover, the rates will also vary in cases of repatriation of assets to Pakistan and in cases of non-repatriation of foreign assets. However, it is not yet clear whether the government would link the scheme with the repatriation of wealth.

It was also reported that the approval of draft for IMF scheme discussed with the prime minister during the meeting.

Govt announces to introduce new tax amnesty scheme before next budget

Earlier, Finance Minister Asad Umar announced that a new tax amnesty scheme would be introduced before next budget.

Talking to the journalists, the minister said the trade fraternity was demanding tax amnesty scheme and that its features were being prepared ahead of the budget for the individuals to declare their local and foreign assets under the scheme.

Umar further said the power tariff is determined by National Electric Power Regulatory Authority (Nepra) and it would still be determined by the regulator. He also said the government would end withholding tax on non-filers in the next budget.

Minister of State for Revenue Hammad Azhar said the government was accumulating data and within a couple of days it would be made public that how many notices had been issued.

To a question, the minister said notices had been issued regarding fake accounts. To another query, Asad Umar said the court had disqualified senior Pakistan Tehreek-e-Insaf (PTI) leader Jahangir Khan Tareen, which did not mean that he was no more a citizen of the country.

“If the prime minister thinks that Jahangir Tareen can give beneficial suggestions, then there is no harm,” he said.

Separately while addressing a ceremony in Islamabad, the finance minister said that the government was mulling to abolish unnecessary withholding taxes.

Asad Umar underscored the need for reforms in property business. He said that the current tax system could not detect transactions and profit in property business.