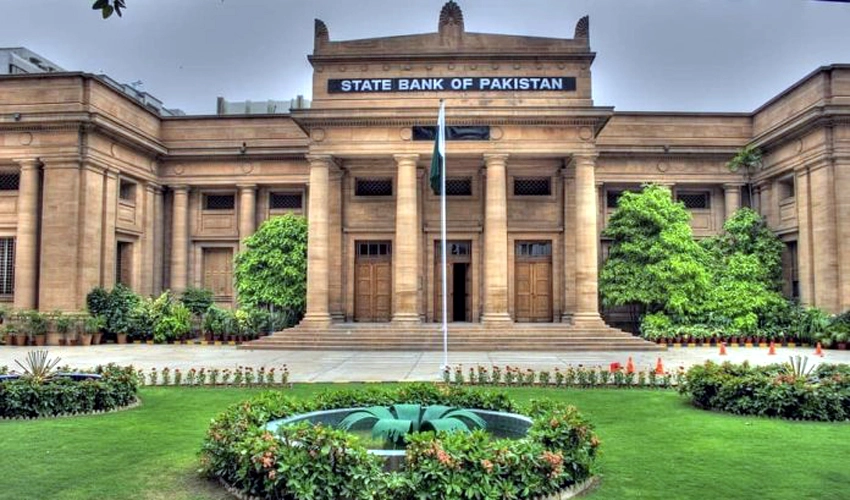

SBP increases interest rate by 1% to 21%

KARACHI (92 News) - The State Bank of Pakistan (SBP) on Tuesday increased the interest rate by one percent, raising it from 20 percent to 21 percent.

The decision was made during a meeting of the Monetary Policy Committee (MPC). The MPC noted that inflation in March 2023 rose further to 35.4 percent, and is expected to remain high in the near term. However, there are early indications of inflation expectations to remain at an elevated level.

The MPC views today’s decision as an important step towards anchoring inflation expectations around the medium-term target, which is critical for achieving the objective of price stability. The committee further observed that Pakistan’s financial sector remains broadly resilient, while economic activity continues to moderate.

Since the last meeting, the committee noted three important developments having implications for the macroeconomic outlook. First, the current account deficit has narrowed considerably, more than previously anticipated, mainly on the back of sizable import containment. Nonetheless, the overall balance of payments position continues to remain under stress, with foreign exchange reserves still at low levels. Second, significant progress has been made towards completion of the 9th review under the IMF’s EFF program.

Third, recent strains in the global banking system have led to further tightening of global liquidity and financial conditions. These have added to the difficulties of the emerging market economies like Pakistan to access international capital markets.

In this context, the MPC considers the current monetary policy stance appropriate, and stresses that today’s decision, along with previous accumulated monetary tightening, will help achieve the medium-term inflation target over the next eight quarters. However, the Committee noted that uncertainties attached with the global financial conditions as well as the domestic political situation, pose risks to this assessment.