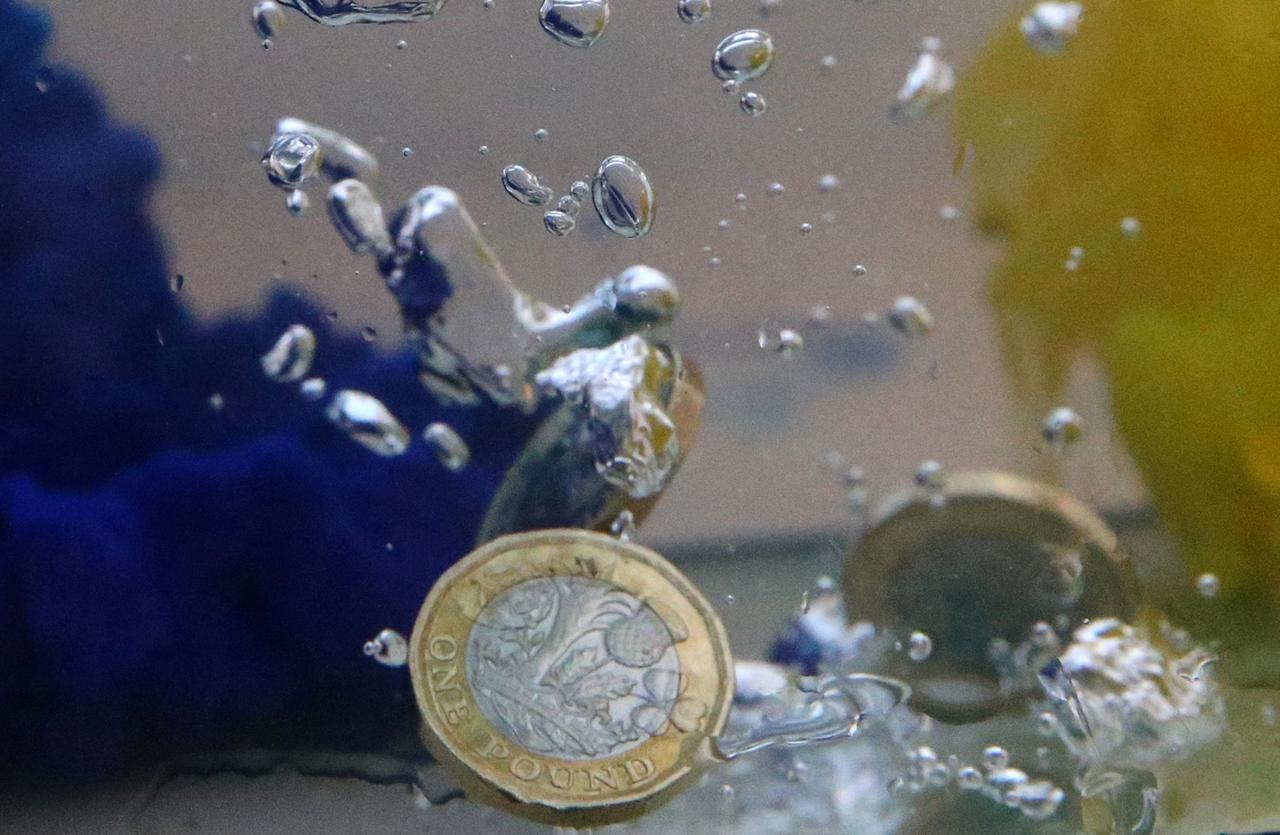

LONDON (Reuters) - Sterling fell sharply on Tuesday after British lawmakers voted down a proposal in parliament that could have prevented a potentially chaotic “no-deal” Brexit.

With two months left until Britain is due by law to leave the European Union, parliament instructed Prime Minister Theresa May to renegotiate an exit treaty that the EU says it will not change.

legislate a delay to Brexit next month

Growing expectations that Britain can avoid a no-deal

Brexit have fuelled a 3 percent rally in the pound this month against the dollar and the euro.

Many traders expected further gains for sterling on Tuesday, but instead the pound tumbled after lawmakers rejected a plan to legislate a delay to

Brexit next month if May fails to secure concessions from Brussels.

“We are looking again at the Brexit deadline of March 29 as a cliff-edge event ... That disappointed many betting on a sterling recovery,” said WorldFirst head of FX strategy Jeremy Cook.

He said there were more downside risks for sterling in the days ahead.

Lawmakers did pass another amendment, put forward by Conservative lawmaker Graham Brady, that was intended to strengthen May’s hand by giving her a clear mandate for a renegotiation in Brussels. But traders said that fears of a no-deal Brexit were driving the pound down.

“She (May) is taking a risky task going back to Brussels to renegotiate,” said Joseph Trevisani, a senior analyst at FX Street in New York.

“As long as May controls the process, sterling is not going to collapse, but the market is still clearly worried about a ‘no-deal’ Brexit.”

VOLATILITY RISING

At 2130 GMT, sterling was down 0.7 percent at a three-day low of $1.3057. It also sank 0.8 percent to 87.56 pence against the euro, the day’s low. Other investors were less concerned by Tuesday’s votes.

“With the Conservative party finally uniting behind Theresa May, reducing general election risks, we see such negative tail risk scenarios as still unlikely to play out,” said Mohammed Kazmi, a portfolio manager at UBP in Geneva.

“Sentiment towards UK assets will now be determined by the next round of negotiations,” he added.

The pound remains well below a 3-1/2 month high of $1.3218, and a spike in volatility in the derivatives market reflects deepening fears about where Brexit, and Britain’s economy, are heading.

Brady’s amendment calls for the Irish backstop arrangement written into May’s Brexit divorce deal, agreed with Brussels, to be removed and replaced with unspecified “alternative arrangements”.

Fed's Powell haunts Hill as Trump rips rate hikes

The backstop is an insurance policy designed to avoid customs checks between EU-member Ireland and the British province of Northern Ireland after Brexit. Many in May’s party oppose it, fearing it could trap Britain in a permanent customs union.

Market nervousness was reflected in a rise in implied sterling volatility on options markets, which has fallen steadily since the start of the year. Overnight implied volatility in particular raced to near 23 vol, the highest since January 15, when lawmakers defeated May’s Brexit deal.

One-month implied volatility rose to its highest in a week and a half at 11.2 vol, a day after seeing the biggest one-day rise since November.